Credit Note – Expenses

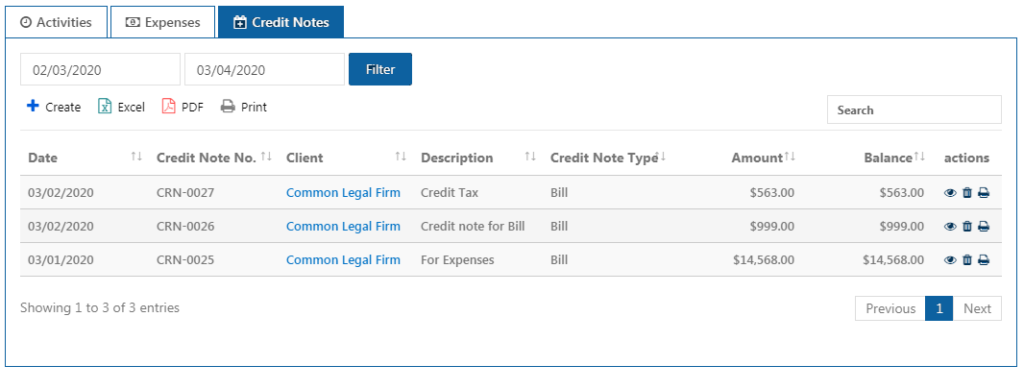

The third tab of ‘Activities & Expenses’ is the Credit Notes.

Credit Notes are particularly useful to give credit or make payment for any expense or invoice and to have it as an evidence or record for tracking the account.

To add a new Credit Note, click ‘Add’ button.

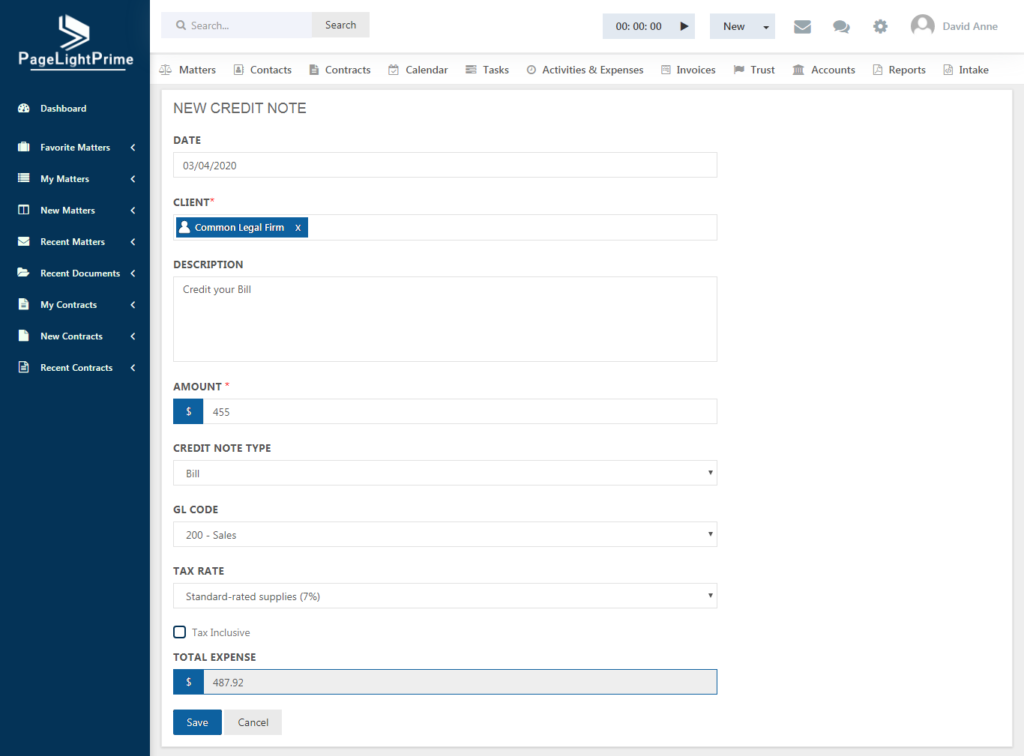

The below page appears.

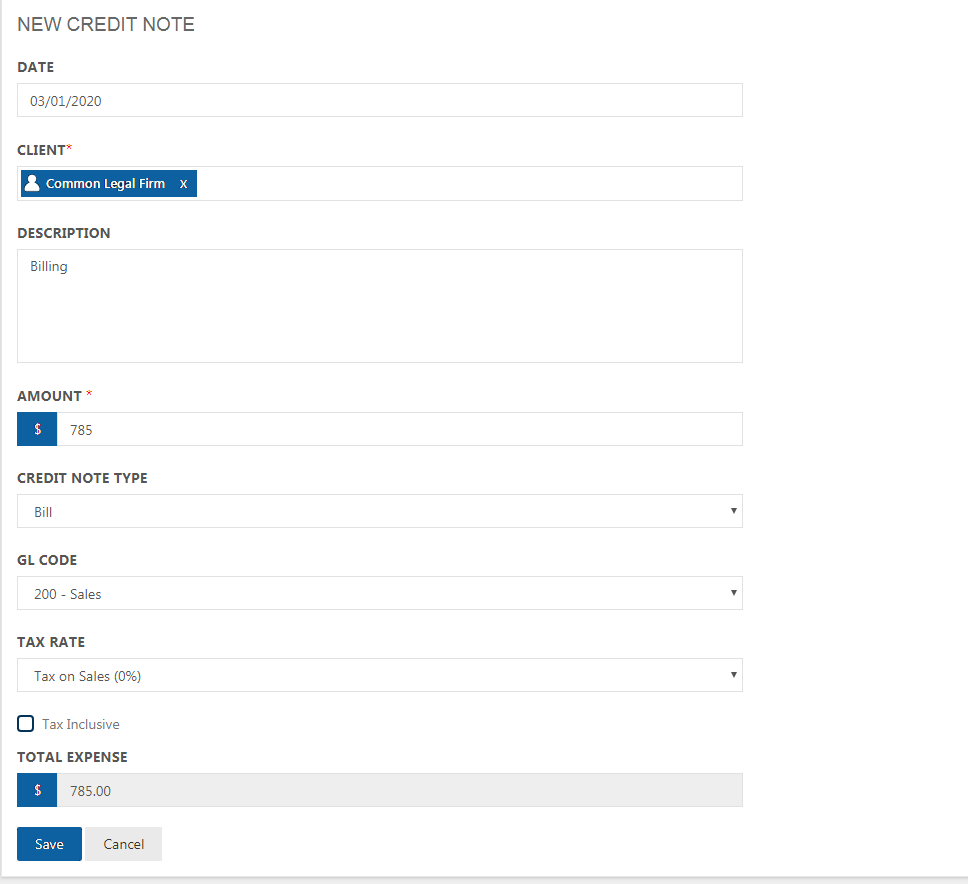

Enter the date in which the credit was made and enter the Client’s Name for whom payment is made along with description. Enter the amount and choose the credit note type.

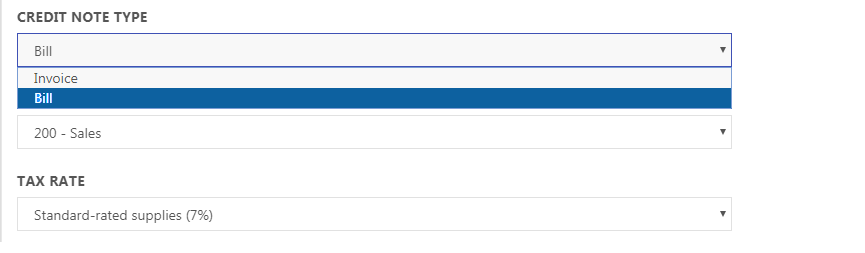

There are two types of credit notes.

When the Invoice Credit Note Type is selected, the credit note is shown in the Invoice.

When the Bill Credit Note Type is selected, the credit note is shown in the Expenses.

Select the GL Code for the Credit Note and choose the Tax Rate for the Credit. When Tax Inclusive check box is selected, the Amount for credit includes the tax amount.

Based on this, the total expense is calculated and shown in the ‘Total Expense’ field.