Chart of Accounts for Lawyers

In the world of law, meticulous record-keeping is not just a best practice; it’s a necessity. Lawyers, whether operating as solo practitioners or part of a law firm, must maintain a clear and organized financial structure to manage their accounts effectively. One essential tool for achieving this is the Chart of Accounts. In this blog post, we’ll delve into the importance of a Chart of Accounts for lawyers and provide some guidance on creating one tailored to your legal practice.

Written by Knowledge Team, posted on November 01, 2023

What Is a Chart of Accounts

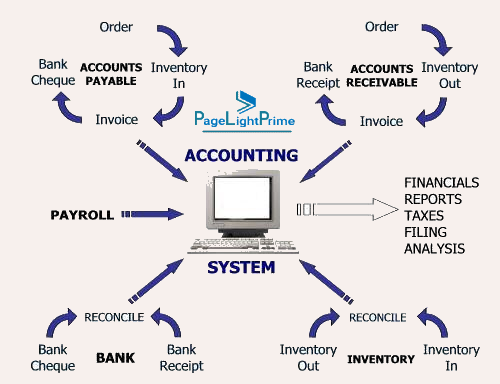

A Chart of Accounts (COA) is a comprehensive list of all the financial accounts used by an organization or individual to record and categorize financial transactions. It acts as a roadmap for organizing and tracking your income, expenses, assets, and liabilities. For lawyers, this financial roadmap is crucial for managing client funds, maintaining compliance with regulatory bodies, and running a successful legal practice.

Why Is a Chart of Accounts Important for Lawyers

Regulatory Compliance

Lawyers are bound by various rules and regulations when it comes to handling client funds. A well-structured Chart of Accounts helps ensure compliance with these rules and provides a clear audit trail.

Financial Clarity

A COA offers a clear overview of your practice’s financial health, making it easier to analyze income, expenses, and profitability.

Tax Management

Accurate categorization of expenses and income through your Chart of Accounts simplifies tax preparation, potentially saving you money and reducing the risk of errors in your tax filings.

Efficient Financial Decision-Making

A well-organized COA provides the data you need to make informed financial decisions, whether related to investing in technology, hiring staff, or expanding your practice.

Creating a Chart of Accounts for Lawyers

A Chart of Accounts is unique to every legal practice, reflecting its specific financial needs and structure. Here’s a general guideline to help you create one:

Account Categories

Start with overarching categories, such as Assets, Liabilities, Equity, Income, and Expenses.

Subcategories

Under each major category, create subcategories tailored to your practice. For example, under Expenses, you can have subcategories like Office Rent, Salaries, Utilities, Legal Research, and Marketing.

Account Codes

Assign numerical or alphanumeric codes to each account. This simplifies the process of entering transactions and reporting.

Account Descriptions

Include clear and descriptive names for each account. Avoid vague or overly generic labels to maintain clarity.

Client Trust Accounts

Maintain separate accounts for client funds (trust accounts). Clearly label these accounts and record all transactions accurately to ensure compliance with ethical and legal requirements.

Regular Review

Periodically review and update your Chart of Accounts as your practice evolves. This ensures it remains relevant and useful.

Consult a Professional

If you’re uncertain about creating a Chart of Accounts, consult with a financial or legal professional who can provide guidance and ensure your COA aligns with legal requirements.

Enhancing Analytics and Reporting

Beyond its foundational benefits, a Chart of Accounts can significantly enhance your practice’s ability to analyze financial data and generate meaningful reports.

Tracking Performance Metrics

By creating specialized accounts within your COA, you can track performance metrics specific to your legal practice. This might include accounts related to billable hours, case-related expenses, or revenue generated from different practice areas. Tracking these metrics provides valuable insights into the areas where your practice excels and where improvements may be needed.

Customized Reports

A well-structured Chart of Accounts makes it easier to generate customized financial reports. Whether you need to provide clients with detailed billing statements or analyze quarterly profitability, your COA will serve as the foundation for these reports, saving you time and effort in the long run.

Budgeting and Forecasting

Your COA can be used as a basis for budgeting and forecasting. By tracking historical financial data, you can make more accurate projections for future expenses and revenue, allowing for better financial planning and resource allocation.

Client Trust Account Monitoring

Your Chart of Accounts should include specific subcategories and accounts for client trust funds. Regularly monitoring these accounts helps ensure that you are adhering to ethical and legal requirements. This also allows you to generate trust account reports to maintain transparency and compliance with clients and regulatory bodies.

Comparative Analysis

Over time, your COA can be used for comparative analysis. You can compare financial data from different years or periods to identify trends, assess growth, and make strategic decisions based on historical performance.

Conclusion: Unlock Financial Success with PageLightPrime

A Chart of Accounts is an indispensable tool for lawyers, helping them navigate the financial complexities of their legal practices. By creating a tailored COA, lawyers can ensure regulatory compliance, financial clarity, and efficient decision-making. Properly maintained accounts benefit not only the lawyer but also clients and the legal system, fostering trust and professionalism within the legal community.

To streamline the process of creating and managing your Chart of Accounts, we recommend considering PageLightPrime, our specialized legal accounting software. PageLightPrime is designed with the unique financial needs of legal professionals in mind, offering intuitive tools to create and maintain your COA, track performance metrics, generate customized reports, and ensure seamless compliance with client trust account management. It’s the ideal solution to help you navigate the intricacies of legal financial management, saving you time and reducing the risk of errors.

In addition, if you’re seeking a dedicated solution for trust compliance, our trust accounting software provides the tools you need to maintain the highest standards of trust fund management, keeping your clients’ assets secure and ensuring compliance with legal and ethical requirements.

Take the time to establish a robust Chart of Accounts with PageLightPrime—it’s an investment in the future success of your legal practice.